When purchasing anything larger than a bicycle, we should consider 2 things:

What is the price?

What does this cost?

Price:

One of the first answers we need to help determine a buying decision is - how much is it? It’s the price, and the price is usually on a tag, or in the title, prominently displayed at the top of the item description. At least it should be.

Cost:

Say you want to buy a house. But you don’t have all the money to purchase it outright. You’ll need to get a mortgage to finance the portion of the price that you don’t have now. This is usually called a mortgage payment.

Cost = Price + Cost of Borrowing (Interest)

Buying a House

People usually say that a house is the largest purchase we make in our lifetime. You’ve heard that.

As a former realtor, I’d like to share something with you, that people do not think about when buying a home for personal use.

Most people get caught up in the price and the negotiation game to get the best deal. The game is a battle of egos as well. Realtor’s egos.

Scenario:

The seller’s Realtor, Tanya, is a very sharp and seasoned Real Estate Professional. Sometimes the deal’s negotiations can go on for a while. Lots of back and forth. Offers and counter-offers. Conditions. Exemptions. Addendums. Amendments. Schedules. And more paperwork than is necessary.

Tanya doesn’t want to budge from the listed price. The house has been on the market for only a couple of weeks. The closer Tanya gets to the asking price for the house, the better a realtor she will prove to be to her clients. This should help her get future referrals and thus more commissions.

The buyer’s realtor, Dan, also looks good if he gets the price down for his clients - for the same reasons.

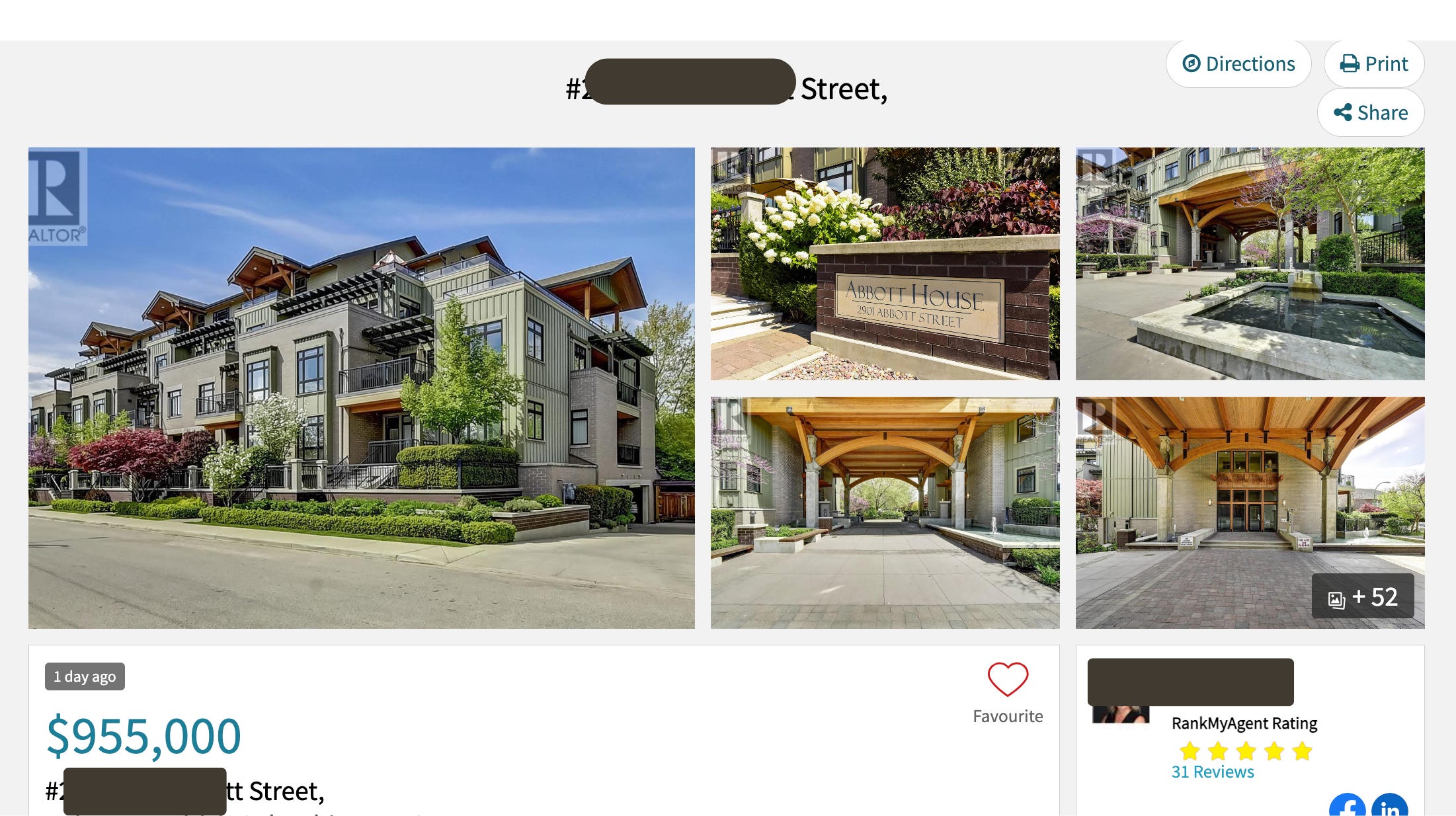

The apartment condo is listed at $955,000:

Dan’s buyers have worked long and hard, scrimped, saved, and borrowed to come up with $200,000 for a downpayment of at least 20% so they don’t have to pay the extra cost for CMHC insurance in Canada. This protects the bank/lender in case the owners can’t make their mortgage payments.

They have good jobs. Combined the husband and wife take home $150,000 a year. They went to a mortgage broker to determine that they will be able to qualify to get a mortgage for $750,000 while using their substantial +20% downpayment.

Because of the current state of real estate in Canada, the buyers have chosen to go for a nice, high-end apartment condo. Based on the mortgage brokers recommendations they should be able to get a mortgage for a $950,000 home.

Price

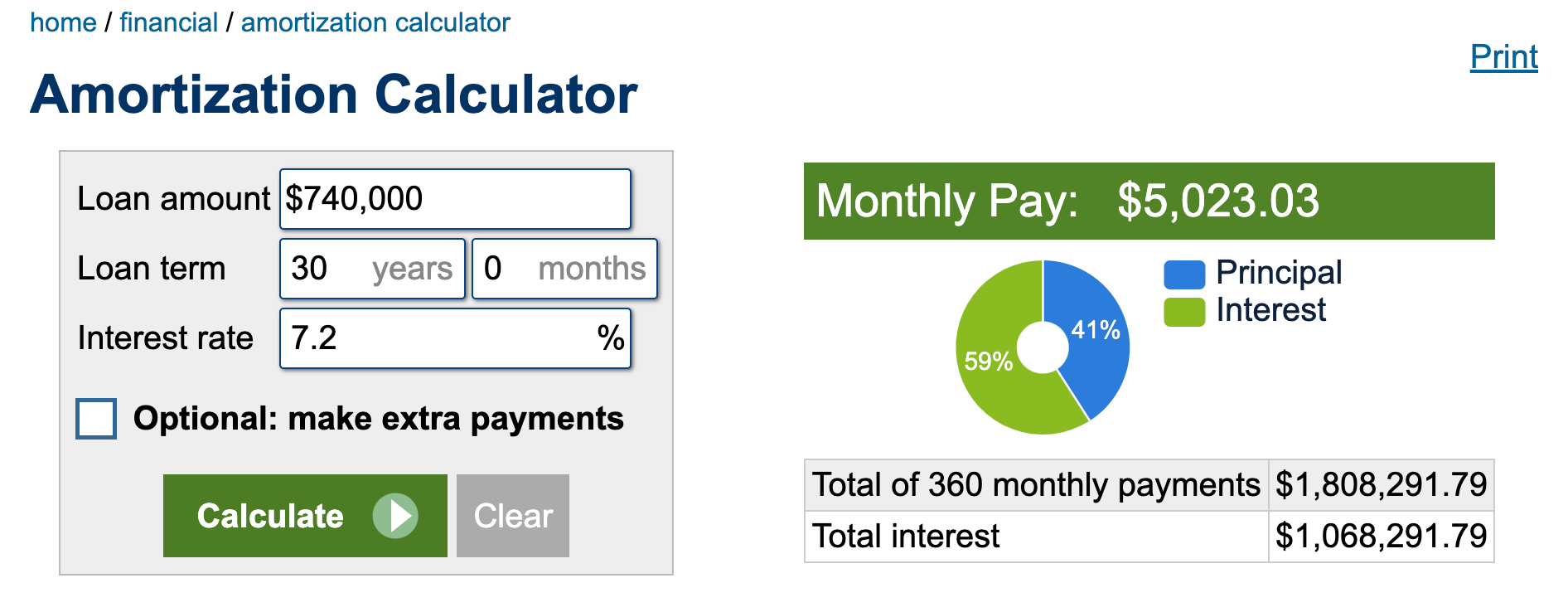

Dan and Tanya had a bloodless battle and after a gruelling day of negotiating, a win - win situation was arrived at and the buyers got the house for $940,000.

So now they know the Price. But what is the Cost?

Cost

And how significant is the Price when factoring in the total cost of the transaction? (TL;DR - minimal)

The mortgage that Dan’s clients ended up signing was as follows:

They will have paid over $1,000,000 just for the cost of the interest alone.

The moral of this story is that the actual price, and the stress of the negotiations to get to that price, is not the most important part of the home buying experience. It is almost reduced to minutiae at the end of the day - or after 30 years.

Did you know?

The Bank of Canada carries out monetary policy by influencing short-term interest rates. It does this by adjusting the target for the overnight rate on eight fixed dates each year. This rate determines how much the Banks charge for mortgages in Canada.

This rate was .25% last January. It has risen to 5.% today. A 2000% increase!

*Update "When the interest is more than your payment, the computer gives up and shows an infinity sign."

According to Randy Robinson, political economist and the director of the Canadian Centre for Policy Alternatives' Ontario office, as many as one in five mortgage holders have seen their amortization periods stretch this year”. (https://www.ctvnews.ca/business/is-an-infinity-mortgage-really-infinite-experts-say-probably-not-but-it-s-not-good-1.6523934#:~:text=%22When%20the%20interest%20is%20more,amortization%20periods%20stretch%20this%20year.)

***

Crazy? Please comment. Share and Like if you want. Thanks to all the subscribers!

The names and scenario numbers are hypothetical. Your mileage WILL vary.

Geez, Paul. This is in B.C.? Or does it vary from province to province? Bank to bank?

And I thought the prime here (5.5% Fed discount currently) was bad. But the Fed in the States adjusts sporadically. The BoC does it 8 times a year? Is the consumer warned in advance which way they'll go?

There are so many layers to the housing crisis in BC and the images you added to your article sum it up perfectly!