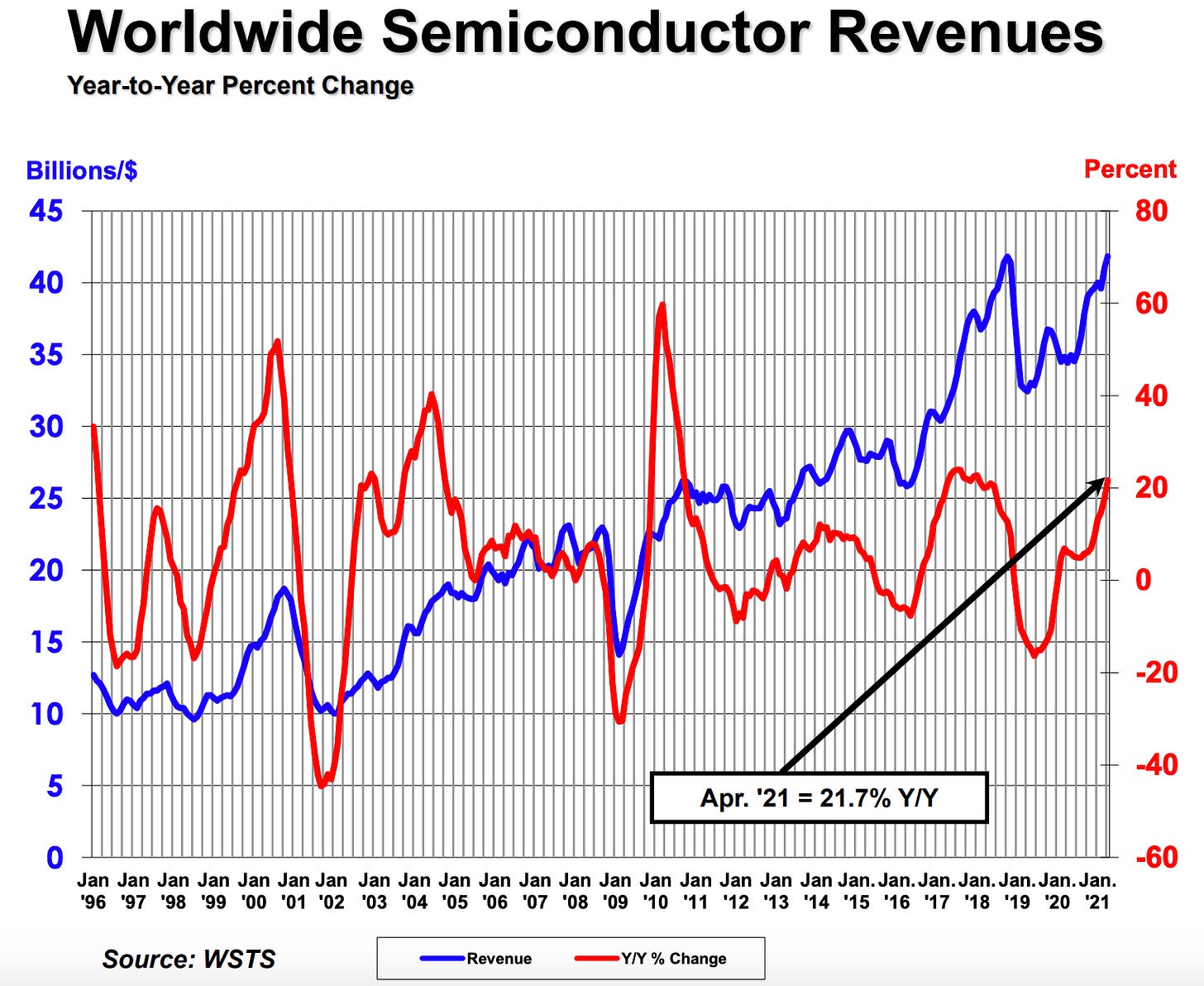

It’s a $500 Billion+ Industry. We’ve all heard about the semi conductor shortage:

Car makers can’t build the number of cars that buyers want.

Mobile phones / smartphones, medical equipment, digital cameras, autonomous vehicles, televisions, washing machines, refrigerators, LED bulbs, AI, IOT devices, security camera systems, and virtually all electronics use semi conductors, also known as semis or chips.

Intel $INTC, Taiwan Semiconductor Manufacturing Company $TSM, Qualcomm $QCOM, Broadcom $AVGO, and Micron $MU, are the largest 5 manufacturers of these chips.

Apple will also manufacture their own chips, ending a 16 year relationship with Intel next year.

With demand so high for the products the manufacturers were caught off guard as the pandemic sped up usage of all things in 2020. They just can’t produce enough. Some say there is a 2 year backlog until manufacturing catches up.

AI in particular is expected to contribute to growth in the semiconductor industry. PWC reports that the market for AI-related semiconductors will grow in revenue to more than $30 billion by 2022 at an annual growth rate of nearly 50%.

Use is predicted to grow by a lot. In all sectors for all products. All the manufacturers or foundries are improving the speed of their chips. Which in turn makes the products they control more efficient and faster.

What a sector for a stock picker!

So should I buy the top semi conductor stocks to take advantage of this future growth and supply and demand problem?

Consider:

A single company, not yet mentioned above, dominates a crucial link in the global electronics supply chain, supplying the semiconductor industry’s most advanced equipment.

$ASML - Makes the machines that all the semi manufacturers need to build their chips. It has 5000 customers. And no competitor comes close.

Originally named Advanced Semiconductor Materials Lithography, in 1984.

Talk about a moat company, Mr. Buffett.

Based in the Netherlands, ASML has become the world’s top supplier of photolithography systems, used in the production of integrated circuits. Although it competes with Japanese giants Canon and Nikon, ASML has nearly doubled its market share in the past 15 years, to 62%. Its edge is that it is the only supplier that has mastered “extreme ultraviolet” (EUV) lithography for chip manufacturing.

The Economist notes, ASML is worth more than Airbus, Siemens or Volkswagen.

One year Chart:

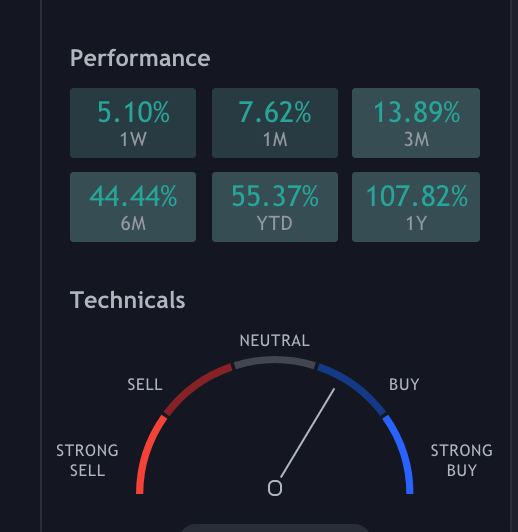

$ASML Performance past year:

Market sentiment:

How did we run short of microchips?

More reading:

The $150 Million Machine Keeping Moores Law Alive

China, Semiconductors, and the Push for Independence - Part 1

China, Semiconductors, and the Push for Independence - Part 2

I’m not a financial advisor, however, I think that the above information could be a starting point for some due diligence. Thanks for reading!